Our Responsible Investing Framework

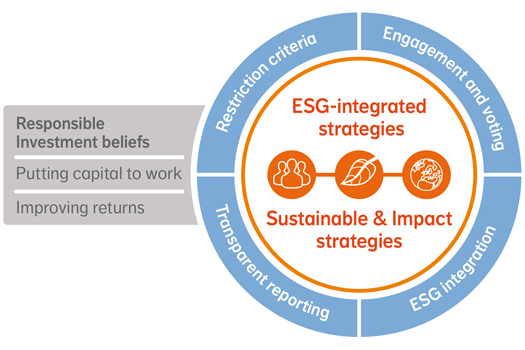

Our beliefs - the whyOur two beliefs - putting capital to work and improving returns – form the starting point, as they explain why responsible investing is important to us.

Putting capital to work

Unicorn Investment Group actively manages assets on behalf of its client base worldwide and participates in global financial markets. We are well aware of the challenges facing the world today, not only in the area of climate change, but also in the social and economic arenas. We have a responsibility to represent the numerous investors who have entrusted their money to us. This extends far beyond the realm of short-term financial gains. We are in a position to make a difference in a far broader context by putting the capital we manage to work.Improving returns

We believe there is a strong link between the longer-term positive impact of responsible investing and improved risk-adjusted returns. The consistent integration of ESG factors not only impacts the well-being of both society and the environment, but enables us to unlock potential value by identifying the associated risks and opportunities.Our approach consists of four building blocks: restriction criteria, engagement and voting, ESG integration and transparent reporting.

Our product offering – the what

Our investment strategies are the tangible result of the beliefs and approach outlined above. We have three types of responsible investing strategy – ESG integrated, Sustainable and Impact – to cater to a variety of client needs across a broad range of asset classes.

Our approach – the how

Restriction criteria

Restriction criteria Engagement and

voting

Engagement and

voting ESG integration

ESG integration

Transparent

reporting

Transparent

reportingFor us, creating a more sustainable future begins with defining broad parameters to pinpoint areas that are ineligible for investment due to controversial activities or conduct. We do this by applying norms-based responsible investing criteria. These criteria reflect our investment beliefs, the organization’s values, relevant laws, and internationally recognized standards from the United Nations Global Compact and the OECD Guidelines for Multinational Enterprises.

Additional restriction criteria for our Sustainable and Impact strategies

In addition to our firm-wide exclusion criteria, we apply more stringent criteria in our Sustainable and Impact strategies. In these strategies, we strive for financial performance while maintaining a strong focus on contributing to sustainable development. This means avoiding investments that are not in line with the “do no harm” principle. As a result, we apply additional restrictions on certain activities, which run counter to sustainable development and may diminish the ability to reach sustainability objectives.

Firm Level

Investment Level

Firm Level

Environmental Objectives

- Providing employees a monthly subsidy on commuting passes for public transportation

- Publicize links of local transit opportunities

- Promoting recycling

- Printing double-sided reports and presentations

- Minimizing printed materials by focusing on using electronic copies of reports and presentations

- Installing water dispensers and providing all employees with reusable water bottles

- Removing plastic water bottles from the office

- Limiting single serve paper or plastic cups

Social Objectives

Governance Objectives

Fostering a Cultural Shift

Throughout this process, one guiding principle is that we do not shy away from difficult questions. And there are many, from organizational questions related to embedding a climate-focused mindset across the firm to technical questions regarding portfolio and holding metrics. Examples include:

- How do we get portfolio managers and analysts to take ownership of climate issues across regions and asset classes?

- What can portfolio teams do to improve their understanding of climate exposure when data are often poor?

- Is there a way to normalize carbon accounting across strategies while avoiding double counting of holdings in stocks and bonds? And what about sovereign bonds, which roll up everything at the country level?

- Should the carbon accounting in short positions held be netted against long positions in the same companies?

We don’t have all the answers, and there is still plenty of work to do. We’ve made good progress toward sizing and attributing our carbon footprint, and are working on implementing carbon emissions data-tracking software. We're in the process of developing year-on-year carbon emissions targets and determining the emissions generated from our firm’s operations. It will take time to set decarbonization targets at the investment vehicle level.

In many cases, companies that are part of the global climate problem are instrumental in the solution, and staying invested offers opportunities to influence corporate behavior for the better. Most importantly, we acknowledge that climate issues present many unknowns—and we simply aren’t equipped to deal with all of them in house. So we need to assess which issues can be addressed internally and which require external help.

Unicorn Investment Group Main Net-Zero Activities

REDUCING OUR EVIRONMANTAL HANDPRINT

What you need to know

How can investors gain confidence that an equity portfolio is invested in companies that are really helping to address climate risk? Focus on a company's carbon handprint, which measures the positive impact, or carbon avoided, by using its products. By combining an assessment of carbon handprints with research of business fundamentals, we believe investors can create a portfolio of companies with superior long-term return potential that are providing solutions to the world's biggest climate challenges.

Incorporating Climate Commitments into Fundamental Research Drives Better Outcomes

OUR CARBON-NEUTRAL PLEDGE

We aim to be carbon neutral in our operations by the end of 2022. We have established a baseline carbon-footprint measurement that covers our global operations and will use data to develop strategies to reduce emissions. We plan to invest in credible offsets for remaining emissions.

GREENING OUR OFFICES

Environmentally conscious practices that complement our day-to-day business operations cover:

Energy consumption

Green-building standards

Technology

Business travel and carbon offsets

Recycling and composting

Paper conservation

Infrastructure reliability

GROUNDBREAKING RENEWABLES INITIATIVE

In September 2021, we entered a first-of-its-kind virtual power purchase agreement (VPPA) with a Green Power Company, one of the world’s largest renewable-energy providers, to match 100% of electricity usage from our US offices and 100% of our US employees’ home electricity usage. To our knowledge, UnicornGroupinvestment is among the first firms in our industry to sign such a VPPA and one of the first companies in the world to match employees’ personal home electricity use with renewable energy.